Welcome to the news section!

Here you will find all the news related to ATRIL and the translation market.

Hungarian language’s uniqueness

Although Hungary lies in the very heart of Europe, the Hungarian language sounds nothing like other European languages, which undoubtedly makes it original and mysterious. Hungarian is believed to have originated in Western Siberia and the languages most closely related to it are those used in the Khanty-Mansi Autonomous District in the Russian Federation. Being a member of the Uralic language family, it is also related to Finnish and Estonian languages.

Difficult to learn

Did you know that Hungarian is one of the most difficult languages to learn? If you browse the Internet in the search of the hardest languages, it will almost always be somewhere near the top of every list. What makes it so challenging? For starters, it’s the lack of similarity between Hungarian and most other European languages. It’s virtually impossible to figure out the meaning of a given phrase based on a word-to-word association. What makes the matter even worse, the language is difficult to pronounce. Many of the sounds of Hungarian are relatively unique and therefore challenging to master for foreigners.

Complicated grammar

Learners of Hungarian often complain about the complex grammatical rules and elaborate case system. Hungarian is an agglutinative language, which means it relies on suffixes and prefixes to determine the grammatical role of words. What makes it even worse (at least for the learners) is the fact that more than one suffix can be put together. For example:

Ház means a house.

Házunk – our house

Házban – in the house

Házunkban – in our house

Unlike English, Hungarian has a flexible word order, at least to some extent. But if you think that it’ll make it easier to learn the language, think again. Word order can too be a source of major headaches to a large number of learners. It is far from entirely free, and there are still some rules you need to remember, like the position of an attributive adjective in a sentence or the fact that the verb is usually at the end of a sentence.

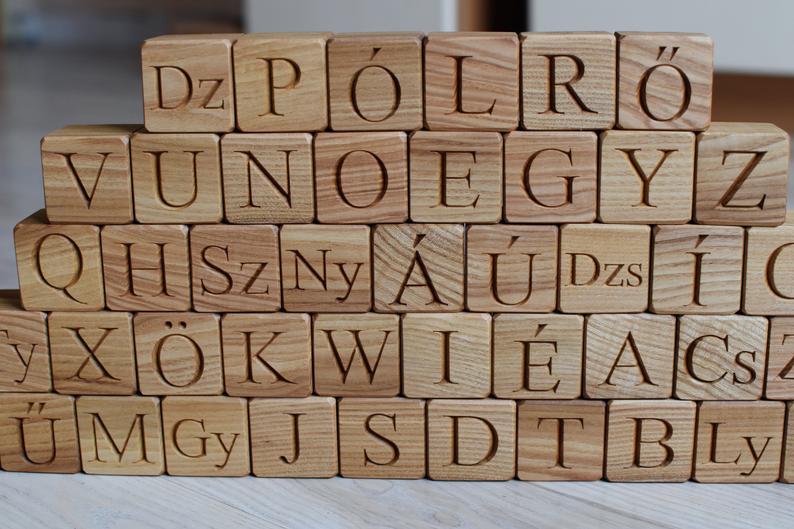

A 44-letter alphabet

There are 44 letters in the Hungarian alphabet, but some of the letters consist of two, or even three other letters. For instance, “dzs”, “sz” or “ly” are also counted as letters, which might be confusing for foreigners.

The longest word

Due to the fact that, in Hungarian, suffixes and prefixes are used instead of prepositions, it’s possible to create really long words, like this 44-letter monster: Megszentségteleníthetetlenségeskedéseiteké. According to various sources, it is the longest word in the Hungarian language, which translates as: “for your [plural] continued behaviour as if you could not be desecrated”.

However, Wikipedia states that because of the language structure, when it comes to word creation, the sky is the limit. If you’re creative enough, you can always come up with yet another suffix or prefix to pile on.

Names – the other way around

Unlike in most European languages, when introducing themselves, the Hungarians always say their name after the surname, also in casual daily speech. And it doesn’t sound pretentious or bureaucratic at all! This is the so-called Eastern name order and is used mainly in Asia. So if you think about the origins of Hungarian language, it shouldn’t come as a surprise.

Two words for red

Red is a very common color in Hungary and it is a characteristic feature of many elements of Hungarian culture: red pepper, Hungarian flag or red wine etc. It would seem that if something is red, it is red, period. But apparently Hungarians love it when things get complicated. When describing something as red, they have to choose from vörös and piros. To the despair of many learners of the language, the adjectives can be used interchangeably in some contexts and not in others.

10 million speakers

Hungarian is spoken mainly in its country of origin – Hungary, with the population of nearly 10 million people. But because of the historical reasons, it is also spoken in the areas surrounding the country, as in the past, parts of today’s Austria, Slovenia and Croatia used to comprise the Kingdom of Hungary. Hungarian is also used by more than 100,000 speakers in the Hungarian American communities in the US. The total number of speakers is estimated at roughly 13 million.

Office furniture: how to choose the best workplace desk

With the era of new technologies many of us have become heavily dependent on the access to the Internet, computers and various IT tools. The number of professions that can be performed from any place, using just a PC or a laptop, is growing every year. Translators belong to a large group of those, who often decide to work from the comfort of their own homes. But how to make working from home as comfortable as possible? What should you keep in mind when designing your own office? Naturally, there’s choosing the right computer, a keyboard and arranging the whole office in the most efficient and optimal way possible. One of the most important issues to consider is choosing the right workplace desk.

Workplace desk ideally suited to your needs

Before buying a desk think what you’re planning to do with it. As a translator, you’ll probably spend long hours sitting at it, trying to meet another crazy deadline. But is that all? Perhaps you also need to meet with your clients or other translators you collaborate with? If so, this should be reflected in the size of your desk and overall arrangement of your office. There are numerous aspects to take into account to choose a piece of furniture that has been adapted accordingly. The basic factors seem to be as follows:

Comfortable, spacious worktop

The general principle seems to be the more space, the better. Naturally however, it all depends on the size of your office. Think about all the things you like to keep on your desk. Working with two screens? Take that into account, as well. Average basic workstation is about 80 centimeters deep and 120 centimeters wide. The depth of the desk is so important because it influences the distance between the computer monitor and your eyes. Experts advise that this value should be at least 50 centimeters.

System unit space

Most computer desks usually come with a special shelf or cabinet for the system unit often referred to as computer case. But take a closer look at how it was designed. At the front of the case, the PC has an optical drive, a switch and other buttons and an increasing number of various ports and slots or a card reader and a display panel. This means you need to have convenient access to the front of the computer case. Preferably, you should be able to reach it without getting up from the chair. Furthermore, bear in mind that the ventilation openings in your PC shouldn’t be covered by any elements of the desk. It’s also worth making sure the cables can be easily connected to the back of the computer. In other words, a workspace desk with a special system unit cabinet is worth considering only if it’s functional. Otherwise, it would be much more comfortable to place the system unit on the desktop or on the floor.

Pull-out keyboard drawer

A popular option in many computer desks, although in most cases a drawer that can be pulled out significantly reduces the comfort of work. It’s located below the table top, which often interferes with the comfortable positioning of the legs and lacks the necessary space to support wrists. Most of these drawers can’t fit a mouse either. In the era of CRT displays, these drawbacks were acceptable, because thanks to the retractable shelf we saved a lot of space on the desktop. However, LCD displays take up much less space, which can be used for placing a mouse and a keyboard.

Power strip area

Besides computers and monitors, you might need several other tools for your work. There’ s a printer, a scanner, external hard drives, routers etc., and all these devices require power, preferably via a filter strip or a UPS. Therefore, make sure if your desk can accommodate all of these items. It doesn’t have to be in a very accessible place, but you should be able to effortlessly connect power cables from all your equipment on your desk.

Ducts and cable openings

Although more and more devices connect wirelessly, cables are still an unavoidable necessity. Make sure your desk has openings (in the worktop, in the back or side walls of cabinets, drawers and shelves) that allow you to easily connect your devices. Special rails and channels (e.g. at the back of the desk) are also useful for organizing the cable routing.

Sit-stand desk

Sitting all day is hardly beneficial for both the body and the mind. That’s why, height-adjustable desks are the best investment to improve health, efficiency and creativity. The way you sit, stand and walk is much more important to your well-being than you can imagine. The truth is, even if you have the most ergonomic office chair and all of the gadgets, spending a whole day in a sitting position will never be good for you. This is where sit-stand desks come into play. If you can afford to shell out a bit more for the arrangement of your office, it’s definitely an option worth considering.

Being able to stand while working (or perhaps switch between sitting and standing position) can help burn more calories and is good for your posture. Moreover, research shows that stand-capable desks can do wonders not only when it comes to relieving pain usually related to sedentary lifestyle, but also have a positive influence on your cognitive productivity. Researchers believe it might be partly caused by reduced body discomfort.

There are many types of sit-stand desks. The most expensive ones are electrically adjustable, which is the most user-friendly and makes it possible to tailor it to your height and needs. You can easily and effortlessly change the height of your worktop, while all of your equipment stays in the same place.

If you’re on a tighter budget, you can opt for an adjustable-height desktop add-on. All you need to do is to place the extension on top of your current sit-down desk. Then there are fixed-height desktop risers, which you can use simply to elevate the height of your monitor or a keyboard, so that they can be used in a standing position. The drawback with the last two option is that they take up much of your space and can dominate your workstation.

The agony of choice?

Workplace ergonomics are an extremely important but often underestimated issue, and this applies not only to offices, but also to domestic workplaces. Unfortunately, when buying a computer desk, we often pay much more attention to its appearance than functionality, the negative effects of which you may feel in the future. It’s worth remembering that though a narrow desk and a designer chair may look attractive, they often don’t provide comfortable conditions for longer work or study, so you’d better look for practical and ergonomic solutions.

Working from home? Make sure you avoid these freelancing mistakes!

A substantial number of translators worldwide are freelancers, many working from the convenience of their own home. While home office has its own undisputable allures, there are plenty of pitfalls you might fall into. Make sure you don’t make the following freelancing mistakes!

Freelancing mistakes: #1 Bad organization.

You get up late, then breakfast, catching up with the news, the social media, a couple of YouTube videos, another cup of coffee… After all, you are your own boss, right? Wrong. By the time you actually get down to working, you realize it’s way past midday and you haven’t done anything. As a result, you end up working late into the night, desperately trying to make up for the lost time.

Good organization is key to successful freelancing. You need to keep a consistent schedule and try to minimize distractions, striving to be more productive. Try to always work within steady hours – for some people it will be early in the morning, others prefer working in the afternoon or evening. As a freelance translator working from home you have the comfort to be able to experiment. Check out what works best for you. But once you find you productivity peak – stick to it.

Freelancing mistakes: #2 Wasting time on multitasking

Many people like to believe they can multitask when it comes to work. In the past, multitasking was believed to increase productivity. But the sad reality is, that it doesn’t. Think about the last time you were trying to do a few things at once. Can you honestly say you gave each of the tasks the attention it deserved? Was it really efficient? The experts say, that when most people try to multitask, they end up switching back and forth to different activities, which has a negative impact on the end-result. You’re losing focus and waste your time, because your brain needs to familiarize itself with the task again.

Freelancing mistakes: #3 Forgetting to plan ahead

First of all, specify your goal well. Consider the pros and cons carefully and a given decision will bring you closer to your goal. As a freelance translator, you need to take care of more than just translation projects. You need to build good relationship with your current clients and look for new ones. You are solely responsible for creating your online presence and marketing your services to others. Thinking ahead is an important skill allowing you to allocate your resources wisely and organize your work in the most efficient way. The last thing you want to do is to make random, haphazard decisions.

Freelancing mistakes: #4 Messy workplace

Seems pretty obvious, but a disorganized working area may really distract you and have a bad impact on your productivity. Let’s start with separating your working space from the rest of your home. This is even more important, if you don’t have a separate room. The lack of a permanent working area at home is one of the biggest mistakes you can make. Keep your workplace tidied and organized – the messier it gets, the more distractions it creates. Disorder prevents you from concentrating on the task you are doing. When the desk is tidy, you’ll be faster and more efficient.

Freelancing mistakes: #5 Not setting a boundary between work and private life

It’s easier to turn off your laptop and leave the company than to stop working when your home becomes both an office and a place to live. You need a lot of self-discipline to work as much as you really should. It’s best if you’ve developed the rhythm to clearly define the times you work and when you definitively call it a day. Keeping a work-life balance is an important factor that helps both prevent work burnout and reduce stress.

No matter if you’re just getting started, or have already learned the ropes of the freelancer lifestyle, making mistakes isn’t something you can avoid altogether. Don’t beat yourself up. The important thing is to take a step back once in a while to look critically at your day-to-day life and see if there’s any room for improvement.